Increased Usage of Stablecoins

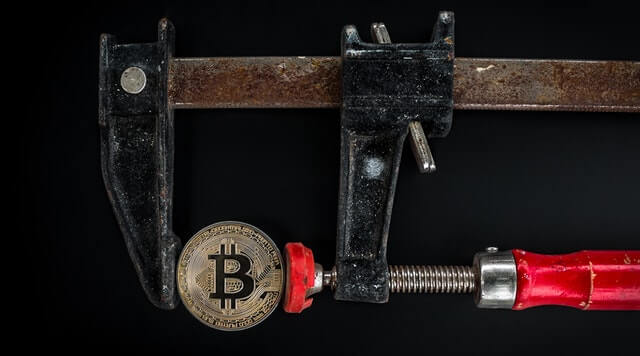

Cryptocurrencies are here to stay – or so it seems. Whether they’ll reach the stability we’ve come to expect from the US dollar or Euro is anyone’s guess, however. Unlike fiat currencies, which are backed by governments and have much larger markets guaranteeing price stability, cryptocurrencies exist on a volatile emerging market that’s open 24/7. In this context, the increased usage of stablecoins is not surprising.

Cryptocurrency Advantages

Cryptocurrencies offer almost instant low-cost transactions, without the complications usually accompanying international money transfers. Sending millions of dollars worth of Bitcoin could cost you just a few bucks, and within ten minutes, the BTC can reach its intended recipient.

With the price of Bitcoin fluctuating between $30,000 and $64,500 in 2021, it would be challenging to use the cryptocurrency as a legal tender. Other cryptocurrencies have similar issues, and there’s where the benefits of stablecoins are the most prominent.

It’s important to note that the total cryptocurrency market cap at the moment of writing this article is $1.9 trillion. When we compare it with the amount of fiat money in the world that people use day-to-day, it still isn’t anywhere close. There is approximately $35.2 trillion in circulation globally, including physical cash, bank accounts, and savings accounts.

Should the total cryptocurrency monetary cap increase to levels similar to those of fiat cash, we would have one of the preconditions for more stable crypto prices. For that to happen, the global markets would have to be more open to crypto as a payment method. Until then, some stablecoins are a halfway solution.

What Are Stablecoins?

Stablecoins are cryptocurrencies with a fixed value, tied to a specific asset. The number of coins in circulation is adjusted according to supply and demand to maintain its price.

Depending on the assets backing them, they can be fiat-, crypto-, or commodity-collateralized stablecoins. There is also a particular type of algorithmic stablecoins which have their supply regulated by a smart contract.

Fiat-Collateralized Stablecoins

Fiat-collateralized stablecoins like Tether (USDT), USD Coin (USDC), True USD (TUSD), and Binance USD (BUSD) are the most common stablecoin type, and they all reflect USD value. If you’re wondering why someone would buy stablecoin based on fiat money, the answer is because these assets have one of the most straightforward ways of operating a cryptocurrency with a stable price.

Keep in mind that this type of cryptocurrency requires a custodian to participate in the process. They hold the appropriate collateral and guarantee the issuance and redemption of coins in circulation. Such stablecoins are frequently independently audited to ensure that collateral is maintained.

Commodity-Collateralized Stablecoins

Hard assets like gold are also used as collateral for cryptocurrencies. While not the most liquid, it’s the safest stablecoin type, along with those with fiat collaterals. Most used are

Tether Gold (XAUT) and Digix Global (DGX). These coins aren’t as traded as much compared to their dollar-tied counterparts and are highly dependent on audits and safekeeping of the collateral, making them less appealing.

Crypto-Collateralized Stablecoins

As the name of these stablecoins suggests, these stablecoins are backed with cryptocurrency. These currencies often have significantly larger collateral to account for the increased volatility compared to those backed by fiat and other assets with a 1:1 ratio between collateral and the coin. DAI is the most prominent example of such currency.

Algorithmic Stablecoins

The only exception on our list of stablecoins is the type using algorithms and smart contracts to retain stability. This type of currency will automatically decrease the number of tokens in circulation if the price falls or increase it if it rises.

Stablecoins in the Spotlight

The reason stablecoins are getting ever-more popular is because of what they represent for fintech. Visa partnered with Circle in December 2020, allowing for transactions to be paid with USDC anywhere Visa is accepted. This was a significant stepping stone for cryptocurrencies, and other mainstream financial institutions also took an interest in the industry.

So if it’s still not clear why someone would use stablecoins, the answer is that stablecoins are a perfect way for traders to preserve their gains in more volatile altcoins by quickly transferring value before it plummets.

A few countries have even introduced regulations for cryptocurrencies, making it increasingly convenient to circumvent banks for international money transfers. Stablecoin transactions are fast, reliable, and have low fees, and users can usually rely on the value they receive.

Are stablecoins a good investment? Well, besides convenience and transfer of value, they don’t represent a lucrative investment opportunity. While they’re not as wildly volatile as regular crypto, they are susceptible to inflation, as their value is tied to fiat currencies.

However, stablecoins are perfect for casino enthusiasts, as most Bitcoin casinos accept them.

Frequently Asked Questions (FAQ)

Why are stablecoins on the rise?

Stablecoins are in focus, as they provide a safer store of value compared to volatile altcoins, and a great way of moving money across borders. Visa’s introduction of USDC payments also drew attention towards stablecoins.

What are the risks of stablecoins?

Stablecoin risk is negligible compared to investing in, say, a dog-themed cryptocurrency. As long as the custodial entities running them have enough collateral and are frequently independently audited, these cryptocurrencies provide the best of both worlds. Their stability is similar to fiat currencies, but they offer fast transactions with low fees.

Why are stablecoins so popular?

Stablecoin popularity results from their ability to tackle the volatility of the cryptocurrency market more efficiently than regular crypto.

Can stablecoins increase in value?

No, they can’t. Stablecoins are deliberately developed to maintain a stable value. Because of that, they are an excellent payment method to use at Bitcoin-friendly betting websites, as these often accept stablecoins.

What is the use of stablecoins?

The increased usage of stablecoins is directly connected to more retail and institutional investors getting interested in the crypto market. They are often paired with other cryptocurrencies and therefore allow for more straightforward trades between them. That’s why Tether (USDT) is one of the cryptocurrencies with the highest daily trade volume – more than twice that of Bitcoin.